1. What are digital wallets and how do they work?

Digital wallets, also known as e-wallets, are virtual systems that allow users to securely store their payment information and make transactions online. They work by storing encrypted payment details such as credit card numbers, bank account information, or digital currencies, which can be used to make payments directly from the wallet without the need for physical cards or cash.

Popular digital wallets include PayPal, Apple Pay, Google Pay, and Samsung Pay, among others. These wallets typically have mobile apps that enable users to make payments conveniently using their smartphones or other digital devices.

2. What is cryptocurrency and how does it relate to digital wallets?

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued and regulated by governments, cryptocurrencies operate on decentralized networks called blockchains. These digital assets can be stored in digital wallets, which serve as a secure place to store and manage cryptocurrency holdings.

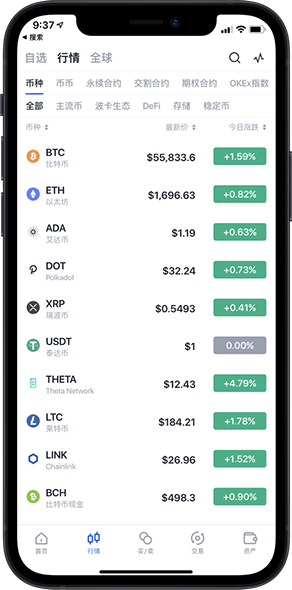

Some popular cryptocurrencies include Bitcoin, Ethereum, and Ripple. Digital wallets designed specifically for cryptocurrencies, known as cryptocurrency wallets, provide additional features like private key management and transaction history review.

3. How does e-money differ from digital wallets and traditional currencies?

E-money, or electronic money, refers to monetary value stored electronically on a device or server. It is commonly used for online transactions, digital payments, and peer-to-peer transfers. While digital wallets can store various forms of payment methods, e-money specifically represents a digital representation of traditional currencies like the US dollar or Euro.

E-money can be stored in digital wallets and used for online purchases, bill payments, and person-to-person transfers. It offers faster and more convenient payment options compared to traditional methods like cash or checks.

4. How can digital wallets improve online payment experiences?

Digital wallets provide several benefits for online payment experiences:

- Convenience: Users can store multiple payment methods in a single wallet and make payments easily without entering payment details each time. - Speed: Digital wallets streamline the payment process, reducing the time required for transactions. - Security: Encrypted payment information stored in digital wallets enhances security and reduces the risk of data breaches. - Flexibility: Digital wallets support various payment methods, including credit cards, debit cards, bank transfers, and digital currencies, giving users more choices. - Integration: Many online platforms and merchants accept digital wallet payments, increasing the options for users to make purchases or payments. - Mobile Payments: Digital wallets often have mobile apps, allowing users to make payments on the go using their smartphones or other portable devices.5. How has fintech contributed to the growth of digital wallets?

Fintech, short for financial technology, has significantly contributed to the growth of digital wallets. Fintech companies leverage technology solutions to offer innovative financial services, including digital wallets, to enhance the convenience and accessibility of financial transactions.

Fintech advancements have introduced various features such as biometric authentication, contactless payments, and secure tokenization, making digital wallets more secure and user-friendly. These technological advancements have also led to increased adoption of digital wallets and a shift towards a cashless society.

6. What are the key considerations for choosing a digital wallet?

When choosing a digital wallet, it is important to consider:

- Security: Look for wallets that offer strong encryption, multi-factor authentication, and additional security features to protect your payment information. - Compatibility: Ensure that the digital wallet is supported by your preferred operating system (e.g., Android, iOS) and can be integrated with your existing payment methods. - Reputation: Research the reputation and reliability of the digital wallet provider, considering factors like customer reviews, industry recognition, and years of operation. - User Experience: Consider the user interface, ease of use, and additional features provided by the digital wallet. - Merchant Acceptance: Ensure that the digital wallet is accepted by a wide range of merchants and online platforms to provide convenient payment options. - Fees: Understand the fee structure associated with the digital wallet, including transaction fees, currency conversion fees, and any additional charges. - Customer Support: Check if the digital wallet provider offers responsive customer support to address any queries or issues you may encounter. In conclusion, digital wallets have revolutionized online payments by offering convenient, secure, and flexible options for users. With the rise of cryptocurrency and the advancements in fintech, the future of digital wallets looks promising, aiming to simplify and enhance the way we handle our finances online.